Permanence

Slack went from $0 to $27B in 5 years. But their real achievement? Making it impossible for companies to leave. When Microsoft launched Teams as a free alternative, everyone expected a mass exodus. It never happened. Why? Because Slack had achieved something more valuable than product-market fit – they'd achieved permanence.

In startups, we obsess over product-market fit (PMF) – that magical moment when you're building something people want. But what happens after your product starts flying off the shelves? What's the next milestone that matters?

The way I think about it, PMF is seeing if the plant has strong enough roots to catch soil. Permanence is how deep those roots can grow.

Permanence isn't just about being sticky – it's about becoming irreplaceable. Think about how impossible it would be for most companies to move off AWS today. That's permanence.

Three key ingredients make it happen:

-

Deep Problem Solving: You're not just fixing one problem – you're solving a whole ecosystem of related challenges. Stripe doesn't just process payments; they handle fraud, compliance, tax reporting, and a dozen other headaches most companies don't want to deal with.

-

Cost Economics: Your scale means you can solve problems more efficiently than any individual customer could. AWS can run data centers better and cheaper than 99.9% of companies ever could in-house.

-

Time Advantage: You become part of your customers' muscle memory. By the time competitors show up, switching feels like more trouble than it's worth.

Here's a controversial take: network effects are overrated for retention. They're great for growth – just ask any social media platform. But they're surprisingly weak at keeping users around.

Remember Google+? They had all of Google's resources and user base, but couldn't pull people away from Facebook. Network effects brought millions of users in, but couldn't make them stay.

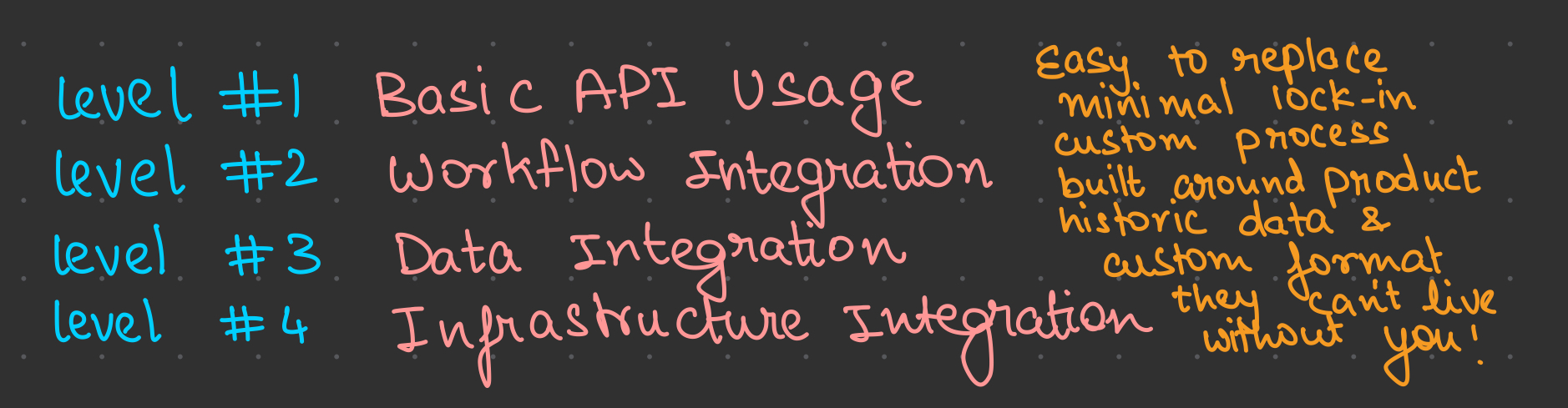

[Diagram: Integration Depth Levels]

I recently watched a company try to switch from Salesforce to a competitor. Nine months and hundreds of thousands of dollars later, they gave up. Why? Because Salesforce wasn't just their CRM – it had become the backbone of their entire sales operation. They had:

- Custom workflows built over years

- Integrations with 12 other tools

- Years of customized reports and dashboards

The switching costs weren't just high – they were prohibitive.

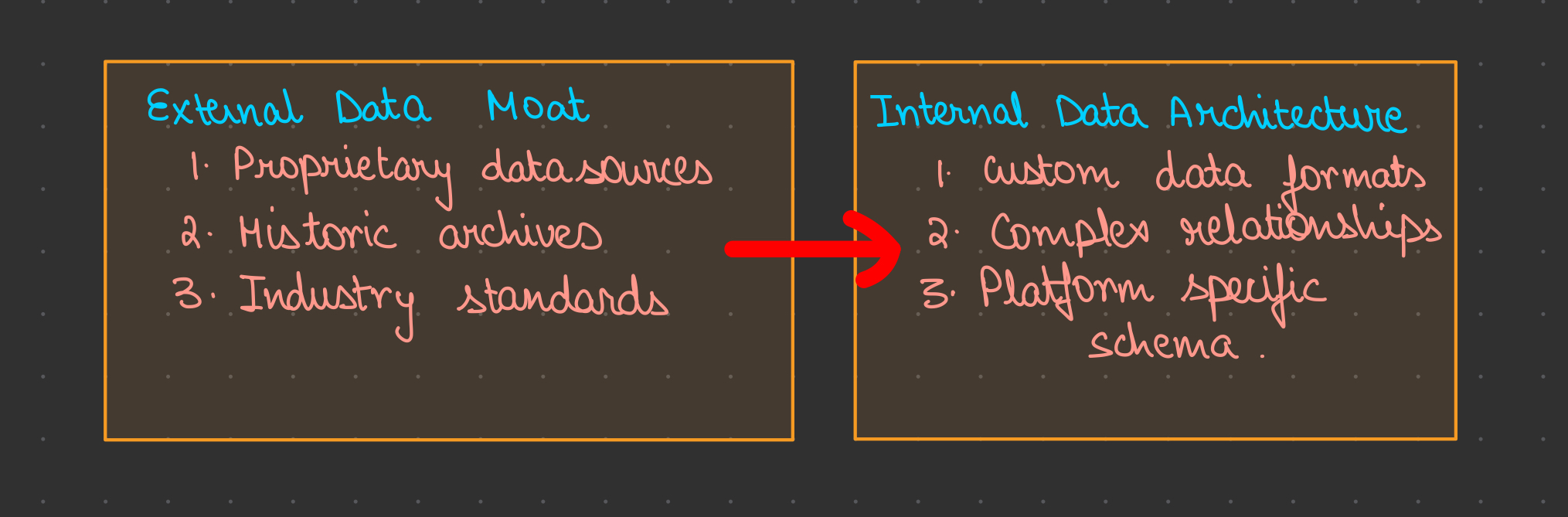

[Diagram: Data Lock-in Types]

Data lock-in comes in two flavors:

External Data Moats Think Bloomberg terminals. Sure, you could get market data elsewhere, but Bloomberg has:

- Decades of historical data

- Proprietary analysis tools

- Industry-standard identifiers

Internal Data Architecture Slack's genius isn't just in storing your messages – it's in how they structure them. Try moving ten years of Slack conversations, with all their threads, reactions, and integrations, to another platform. Technically possible? Yes. Practically feasible? Not really.

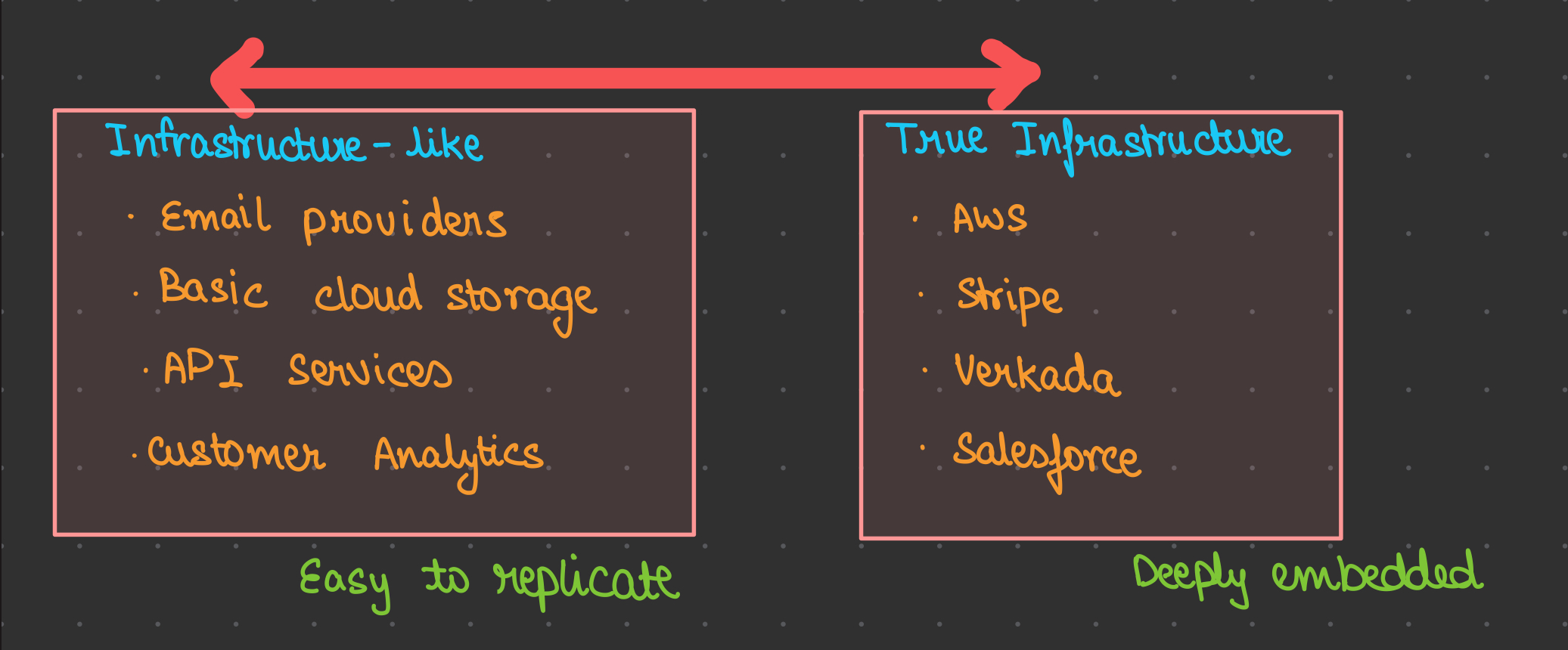

[Diagram: Infrastructure vs Service Spectrum]

Let's talk about the difference between being infrastructure-like and true infrastructure:

Infrastructure-like (Weak Position)

- OpenAI: Easy to swap with Claude, DeepSeek, or others

- Email providers: Simple to switch between vendors

- Basic cloud storage: Relatively painless to migrate

True Infrastructure (Strong Position)

- AWS: Entire companies are architected around their services

- Stripe: Deeply embedded in payment flows and financial reporting

- Verkada: Integrated into physical security systems

The difference? True infrastructure requires surgery to remove. Infrastructure-like services just need a band-aid change.

The Legacy Industry Opportunity

Here's where it gets interesting – the best opportunities for permanence often hide in unsexy, legacy industries. I'm talking about:

- Industrial supply chains

- Construction management

- Healthcare administration

- Government contracting

Why? Because these industries:

- Move slowly (giving you time to entrench)

- Have high switching costs

- Value reliability over novelty

But there's a catch: VCs typically don't love these plays. They want consumer apps and AI platforms that can grow 100x in a year. Building permanence in legacy industries is more like growing a redwood – slow at first, but ultimately unshakeable.

How do you know if you're achieving permanence? Look for these signals:

- Customer switching attempts that fail

- Integration requests from other tools in your space

- Customers building significant workflows around your product

- Industry standards forming around your conventions

Here's the thing about permanence – you can't force it. The harder you try to lock customers in, the more they resist. True permanence comes from being so valuable that leaving doesn't make sense.

Think about Git and GitHub. They're not just version control – they're how modern software development works. No one's locked in, but everyone stays because the ecosystem is just that valuable.

Building for Permanence

-

Foundation First

- Solve a core problem extremely well

- Build trust through reliability

- Create clear, documented APIs

-

Expand Thoughtfully

- Add adjacent solutions that compound value

- Make integration easier than building in-house

- Create unique data advantages

-

Enable Building

- Let customers build on top of you

- Become part of their infrastructure

- Make their success dependent on yours

Permanence isn't a feature you can ship or a metric you can hit overnight. It's a state that emerges when you've become so deeply embedded in how your customers work that removing you would be like trying to remove the foundation from a skyscraper – technically possible, but practically insane.

Remember: PMF tells you if you can grow. Permanence determines if you'll last.

^1: The term "product-market fit" was coined by Marc Andreessen in 2007, but the concept has evolved significantly since then.