Hype Cycles

A lot of this conversation is inspired by and building up from a piece written by Trae Stephens called Venture Capital’s Need for Sheep and conversations with a current university student trying to dabble in the world of startups.

I have a personal philosophy — if there’s an abnormal amount of VC money pumping into a specific industry, I don’t think it’s a viable industry to target.

I wasn’t in venture capital when the web3 hype-cycle was getting off the ground, but I remember seeing tweets about AI being the next big thing convert into being one of the first words coming out of a founder’s mouth immediately post pleasantries. While there is money to be made building AI wrappers or even trying to build foundational models or infrastructure, I don’t think it’s the most optimal positioning to hit a home run.

I’ve spent a lot of time thinking about the math behind encryption systems and zero-knowledge proofs and while incredibly fascinating, I think they don’t deserve to have a scope in startups outside the realm of cybersecurity. They are incredibly interesting technologies but they don’t have a direct mapping to something the average Joe would care about. The best litmus test one of my mentors gave me was asking what the response of a prospective user would be — is it a “hey, this is something cool to have” versus something that users will pay to have because it solves a genuine problem?

The argument I’ve heard behind chasing hype cycles is the amount of VC money in the industry makes it a North Star to some of the smartest people around — the appeal of starting a venture attracts some of the smartest minds and the easily accessible sources of money leads to some of the smartest minds leaving their cushy well-paying jobs at established players to try and get something off the ground. But there’s also somewhat of a trickle-down effect to be had in this industry — the more VC money in space, the more companies getting funded, the more these companies are spending money on organizing university hackathons, and events and generally getting students thinking about these technologies.

But these hackathons have more implications than just opening another hiring pipeline for these companies. What it does is that it normalizes students becoming founders in these hyper-areas which is problematic for a few reasons.

There are a few reasons why this is wrong — the primary one being that it doesn’t allow for university students to build things THEY find “cool” and are instead allured by the lull of money and naturally gravitate to build in that domain. This leads to more startups building ChatGPT/ web3 wrappers than startups solving genuine problems. Additionally, this also means that the companies coming from this cycle have valuations artificially popped up with venture money, and when the hype dies away and things boil down to revenue and the metrics which truly define a company — the company wouldn’t last till the end of the day. I’d argue that this leads to a lower chance of the next unicorn coming directly out of a university.

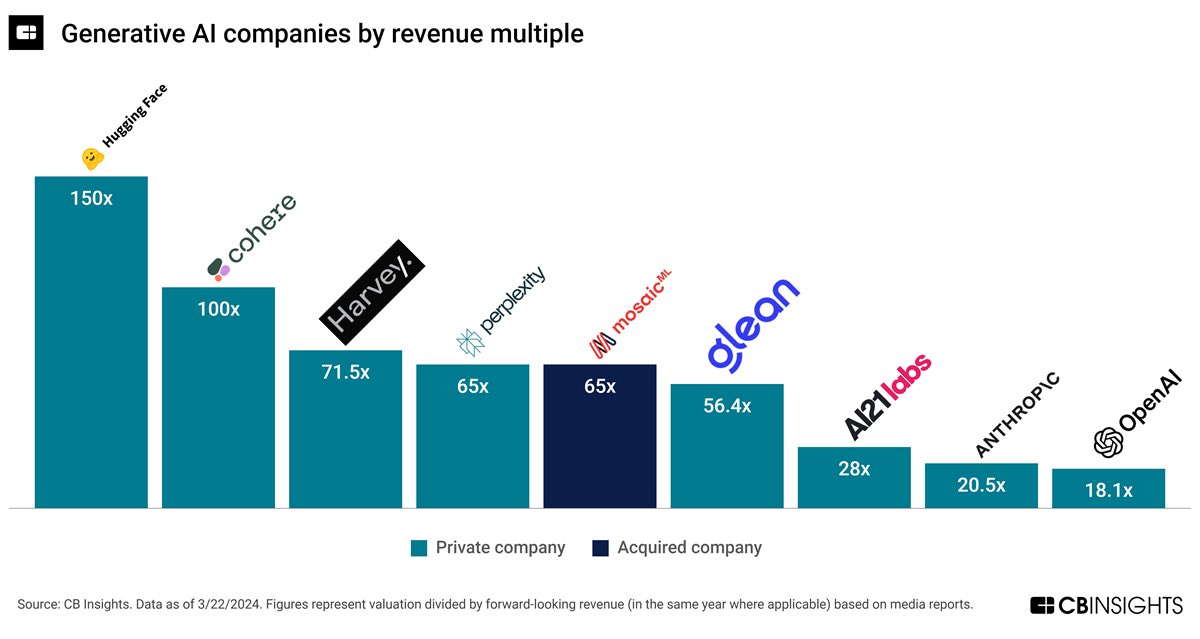

Arguably with the AI boom too, the players who had to win something had already won it well before the new generation of VC hype started. The companies with the highest profits emerging from this race were OpenAI, Anthropic, Microsoft, and Nvidia. An interesting trend worth noting is that none of these raised any money from the AI-focused arm of any fund. The other side of the same coin is the paradigm where other generative AI companies are raising at multiples previously unheard of in the industry.

But if there’s money to be made it’s not the made in the aftermath. By the time VCs have realized that the domain holds something new, the biggest players have emerged and the game has been won — there’s no point in building in AI now. There’s a next to zero chance you can make the outsized return which you need to make to make it worth a VC’s time.